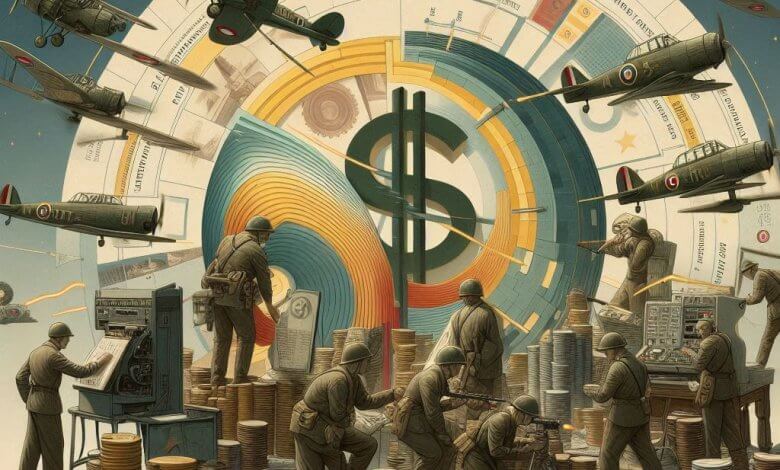

In addition to the pleasant naval issues, wartime additionally imposes exquisite financial traces. Budgets for peacetime need to be fast transformed to warfare economics, which often call for fantastic expenses on humans, logistics, and weaponry. In these situations, the monetary device turns into the inspiration of country wide life, influencing how conflicts are waged and how societies cope with monetary problems.

1. Shifting to a War Economy

Daily monetary operations are often affected throughout instances of struggle. Governments need to invest in navy production in preference to client organizations. This alternate is referred to as the struggle financial tool transformation. Financial frameworks are critical for:

Allocating a number costs to the navy industry

shifting sources and labor from civilian to military utilization

Managing charge stability and inflation

To make certain that assets are directed towards the struggle strive, important banks and finance ministries workout emergency manipulate over some of monetary machine additives.

2. War Financing Methods

Governments use a aggregate of 3 primary system to finance wartime sports activities activities:

A) Taxation

One of the primary degrees in investment a conflict is elevating taxes. Additionally, governments can impose brief conflict levies, growth income taxes, or impose new taxes on items. For instance, numerous international locations substantially improved the load of corporate income taxes and imposed them eventually at some point of World War II.

B) Taking out loans (War Bonds)

Borrowing coins from the general population is some different important tactic. To inspire residents to put money into their usa’s triumph, governments problem battle bonds. By disposing of surplus forex from circulate, these bonds no longer handiest increase charge variety but also beneficial resource in inflation control.

Warfare bond campaigns were considerably marketed in global locations together with the US with posters, film big name endorsements, and patriotic appeals, turning finance right proper proper into a collective strive.

C) Money Creation

Primary banks may additionally inn to growing extra money at the same time as borrowing and taxes are not sufficient. Although this could help finance short-term desires, if it isn’t always properly managed, it frequently effects in inflation or maybe hyperinflation. For example, excessive remote places cash manufacturing at some point of World War I induced Germany to face severe inflation.

3. Controlling Rationing and Inflation

Systems of warfare investment need to carefully manage inflation. Fees can upward push rapid while extra cash is spent on struggle and much much less consumer gadgets are to be had. In order to address this, governments finished:

Controls on fees

Caps on wages

Systems of rationing

Fair distribution of necessities like meals, fuel, and garb is ensured through rationing. Additionally, it lets in financial system stabilization and public steerage during extended conflicts.

4. Post-War Economic Impact

Financial picks made for the duration of a battle have lengthy-term results. Following a war, international locations frequently deal with:

High countrywide debt

Devaluation of forex

Reconstruction costs

Struggle, regardless of the truth that, may additionally spur creativity and enterprise corporation growth. Fueled with the beneficial aid of safety contracts and new technology, put up-World War II recovery inside the United States contributed to a period of financial fulfillment.

Final Thoughts

A wartime monetary device is greater than simplest a calculation; it’s miles a manner of surviving. International net sites can maintain their army operations with out their monetary system collapsing via hanging a stability amongst taxation, borrowing, and expenditure limits.

Knowing how finance abilities inside the course of a battle permits one to find the decision of the sport stress inside the again of the battlefield: economic technique and financial resiliency.